CEMATRIX Q4 FY24 Review and FY25 Financial Forecast & Outlook

Navigating Challenges and Seizing Opportunities: A Strategic Review of Cematrix’s Performance and Growth Prospects

I firmly believe that if you can’t forecast a business, you don’t truly understand it. In my deep-dive research report on Cematrix (linked here), I projected Q4 Adjusted EBITDA to reach $1.4M—and the company delivered $1.44M. A near-perfect forecast like this only strengthens my confidence!

Now, let's break down Q4’s balance sheet, income statement, outlook, and F25 revenue & Adjusted EBITDA forecast and valuation.

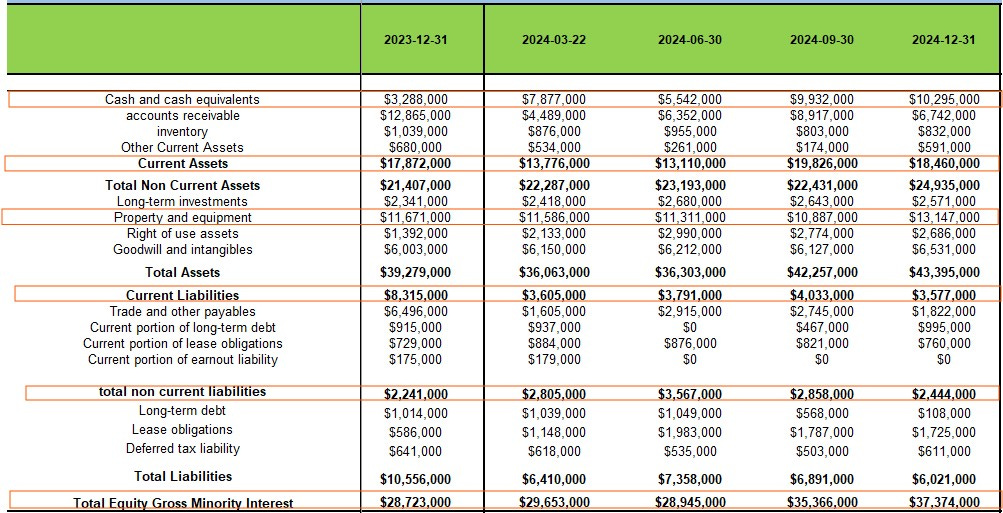

First up—the balance sheet. How does it stack up against the last four quarters? Are the numbers trending in the right direction? Let’s dive in.

Cash has consistently increased from Q4 FY23 to Q4 FY24, with the exception of Q2 FY24, which was a challenging quarter for the company due to project delays. In every other quarter, the company has successfully improved its cash position. The company’s current assets, current liabilities, and working capital are in strong shape, and it is currently trading at a current ratio of 5.16x.

The company’s Property, Plant, and Equipment (PPE) rose from $11M to $13M between Q3 FY24 and Q4 FY24. Notably, in Q4 FY24, Cematrix made a strategic investment in a new state-of-the-art dry-mix unit, at a total capital expenditure of $1.9 million, sourced from a third-party vendor. This highly mobile unit will enhance our dry-mix production capacity and provide a significant cost advantage over competitors relying on ready-mix. It will be deployed within MixOnSite to support our growth initiatives in the USA.

Turning to total equity, the company’s equity has grown from $29M in Q4 FY23 to $37M in Q4 FY24, indicating an increase in Net Book Value (NBV). I am very pleased with the upward trend in the company’s NBV.

At $0.19 per share, the company is currently trading at 2.8x cash per share.

Q4 Income Statement Review vs. Last Eight Quarters, FY25 Forecast, and Valuation: