Firan Technology Q1 F25 Review –Digging Past the Year-Over-Year Lens $FTGFF $FTG.TO

A Quarter That’s More Than Meets the Eye

Before we dive into Firan Technology, here's a brief overview of the company for those who may not be familiar with what it does.

Firan Technology Group Corporation:

FTG is an aerospace and defence electronics product and subsystem supplier to customers around the globe. FTG has two operating units:

FTG Circuits: A manufacturer of high technology, high reliability printed circuit boards. Our customers are leaders in the aviation, defence, and high technology industries. FTG Circuits has operations in Toronto, Ontario, Chatsworth, California, Fredericksburg, Virginia, Minnetonka, Minnesota, Haverhill, Massachusetts, and a joint venture in Tianjin, China.

FTG Aerospace: Designs, certifies, manufactures, and provides in-service support for illuminated cockpit products and electronic assemblies for original equipment manufacturers and operators of aerospace and defence equipment. FTG Aerospace has operations in Toronto, Ontario, Calgary, Alberta, Chatsworth, California, and Tianjin, China.

FTG remains clearly positioned as an aerospace and defence electronics company. FTG is now engaged with most of the top aerospace and defence prime contractors in North America and is making significant progress penetrating markets beyond this continent. FTG’s focus on these markets is based on a belief that it can provide a unique solution to its customers and attain a sustainable competitive advantage

Let’s first look into key performance indicators:

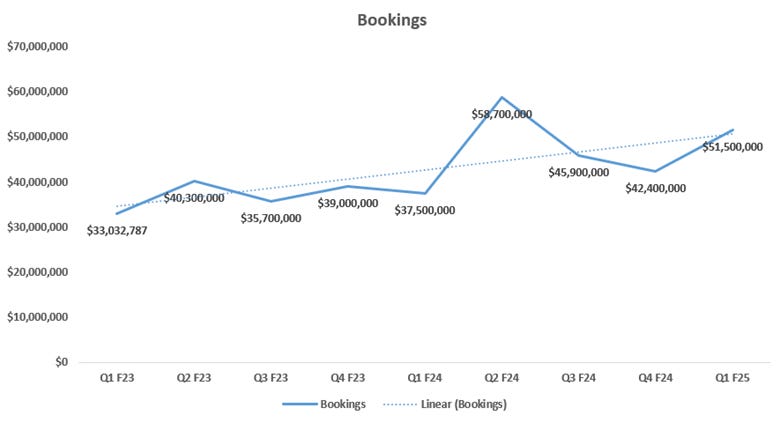

Bookings for last nine quarters:

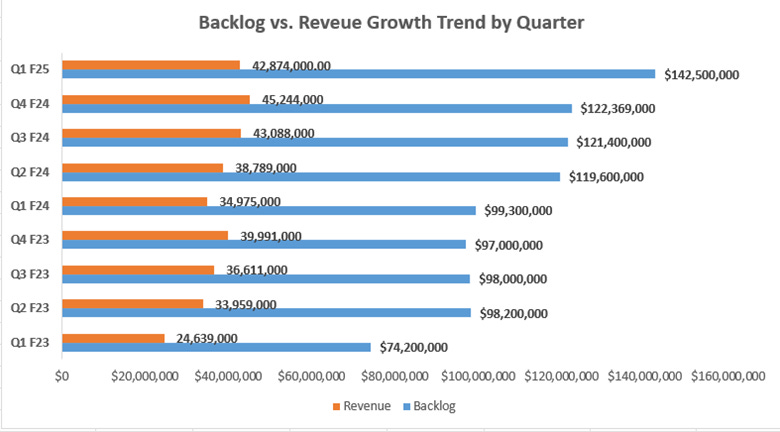

Backlog & Revenue trend for the last 9 quarters:

1. Backlog (Blue Bars):

Shows consistent and strong growth over the 9 quarters.

Grew from $74.2M in Q1 F23 to $142.5M in Q1 F25.

That’s a 92% increase over two years, signaling strong forward demand and healthy order intake.

2. Revenue (Orange Bars):

Also trending upward, though at a slower and more volatile pace than backlog.

Grew from $24.6M in Q1 F23 to $42.9M in Q1 F25, a 74% increase.

Revenue peaked at $45.2M in Q4 F24, slightly declining in Q1 F25.

Let’s review in income statement section on what $142M means for F25 and F26 revenues?

Backlog + Revenue + Bookings Synthesis:

Tracking FTG's Financial Performance Over the Last Nine Quarters, Outlook, F25 Forecast and Valuation, and My Investment Decision:

Sequential and YoY Insights on Balance sheet: