GEODRILL $GEO.TO GEODF.US - Deep Dive Research Report # 25

From West Africa to South America: Scalable Growth Backed by a High-Performance Rig Fleet

Table of Contents:

1) Business Overview

2) Competitive advantage

3) Key Performance Indicator

4) Detailed Quarterly Historical Financial Analysis

5) F25 Forecast

6) Valuation

7) Valuation vs. Industry Peers

8) Options and Warrants

9) Management and Board of Directors

10) Insider and Stock Ownership

11) Risks

12) My Investment Decision

Business Overview:

Geodrill runs a fleet of advanced drilling machines that can handle a variety of tasks. These include machines for surface drilling (like for soil and rock samples), underground drilling, and precise grade control. A special type of drill they use — called a multi-purpose rig — can easily switch between two common drilling methods:

RC drilling, which is fast and efficient for getting samples from shallow depths

Core drilling, which is more accurate and used for deeper or more detailed work

Instead of bringing two different machines to a job site, Geodrill’s multi-purpose rigs can do both jobs. This saves time, money, and effort for clients.

Geodrill operates in six countries across Africa and South America. To support its operations, it uses high-powered air compressors and booster systems to drill deeper and collect better-quality samples.

They also have top-notch service centers and supply bases in Ghana, Côte d’Ivoire, Egypt, Chile, and Peru. These hubs store parts, tools, and equipment — so Geodrill can quickly move everything it needs to job sites with minimal delays and lower transport costs.

Why Geodrill Has an Edge?

1. Business Growth Across Regions

West Africa (Ghana, Côte d’Ivoire, Senegal):

Geodrill has a strong presence and recently won $150 million worth of major contracts in 2024—both for surface and underground drilling with top-tier mining companies. These deals are expected to boost revenue for the next 3–5 years.

The plan is to add more rigs, serve new clients, and expand into new West African countries.

Mali & Burkina Faso:

Due to safety concerns, Geodrill fully exited Mali in 2024 and Burkina Faso in 2023, relocating equipment and staff to safer neighboring countries.North Africa & Middle East (Egypt, Saudi Arabia):

Geodrill continues strong operations in Egypt with a long-term underground drilling contract. In late 2024, it also set up a company in Saudi Arabia to pursue new projects in 2025.South America (Chile & Peru):

Drilling took place in both countries in early 2024, but Chile paused during winter. The goal is to expand to work year-round by diversifying clients. In late 2024, Geodrill secured $49 million in new contracts in Chile, showing growth momentum. It also has a company registered in Brazil and is looking to expand into other South American countries.

All in all, Geodrill is active in:

West Africa: Ghana, Côte d’Ivoire, Senegal

North Africa: Egypt

South America: Chile, Peru

Its focus is still gold, but it’s also getting into other minerals like copper, lithium, zinc, iron ore, and uranium.

Its location also gives it the flexibility to expand into other nearby countries in the Middle East, Africa, and South America.

Key Performance Indicator:

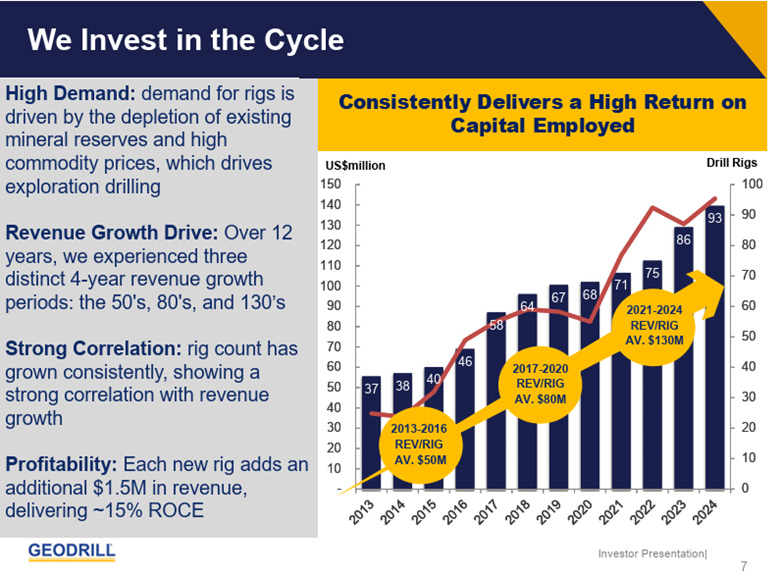

Drill Rigs:

As of March 1, 2025, Geodrill added one more rig, making it a fleet of 96 rigs in total.

The chart above highlights a clear upward trend in the number of drill rigs over time, underscoring the company’s consistent investment in capacity to capitalize on commodity cycles.

Consistent Rig Growth:

Rigs increased from 37 in 2013 to 93 in 2024—a 151% increase over 11 years.

The growth appears steady, particularly accelerating post-2016, with only a slight dip in 2022.

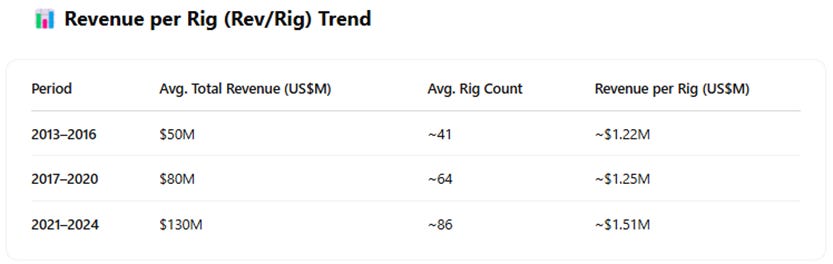

Stable Efficiency (2013–2020):

Rev/Rig remained fairly constant at ~$1.2–1.25M despite more rigs being deployed, suggesting consistent productivity per unit.

Efficiency Gains (2021–2024):

Rev/Rig jumped to ~$1.51M, indicating better utilization, higher pricing and more contracts per rig.

Capital Efficiency & Profitability:

Each new rig adds ~$1.5M in revenue with ~15% Return on Capital Employed (ROCE), indicating that expansion is value-accretive.

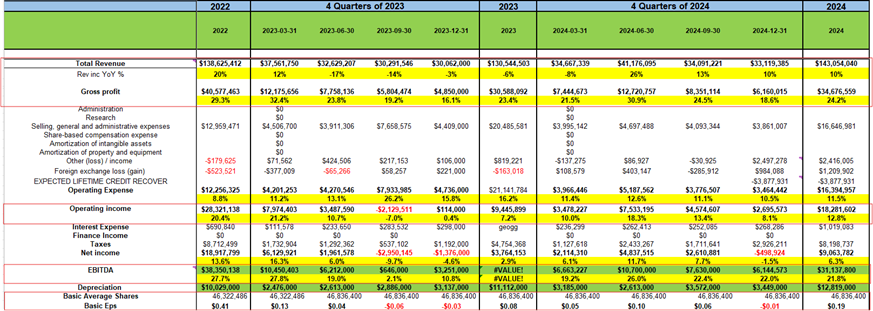

Historical Financial Analysis:

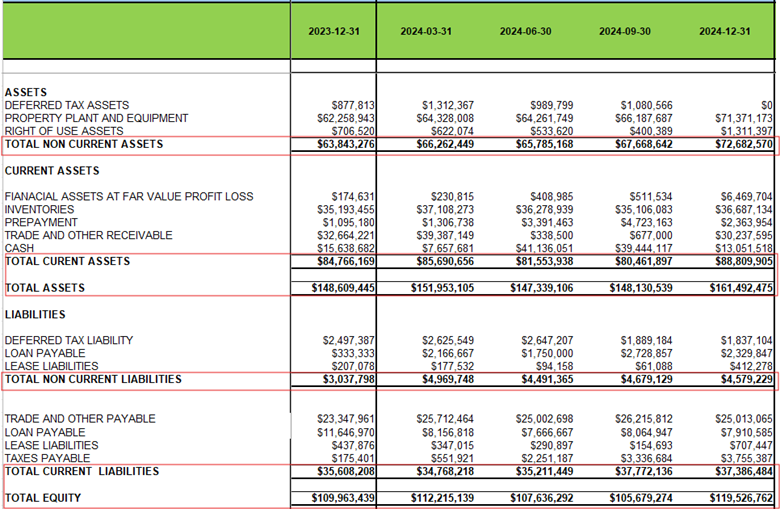

Balance Sheet:

All numbers are in USD unless stated otherwise.

Total Assets

Growth: From $148.6M → $161.5M over the year

Trend: Steady increase quarter-over-quarter, with a notable bump in Q4 2024

Driver: Mainly due to:

Rise in Property, Plant & Equipment (from $62.3M → $71.4M)

Increase in Cash and Trade Receivables in Q4

🏗️ Non-Current Assets

Grows from $63.8M to $72.7M

Key driver: Property, Plant & Equipment increase by ~$9.1M, drill rigs or infrastructure

💵 Current Assets

Increase from $84.8M to $88.8M

Mixed movement during the year but ends higher

Notable Q4 surge in:

Cash ($15.6M → $20.3M)

⚖️ Liabilities

🔹 Non-Current Liabilities

Fairly stable throughout, ending at $4.58M

Slight increase in Loan Payable and Lease Liabilities in Q4

🔸 Current Liabilities

Rises from $35.6M to $37.4M

Biggest change: Loan Payable jumps sharply in Q2 & Q3, but decreases slightly in Q4

📈 Total Equity

Strong growth from $109.96M → $119.53M

Indicates solid internal capital generation, likely from retained earnings

🔍 Overall Commentary

Solid, balanced growth: Both assets and equity are increasing steadily, with no alarming debt spikes.

Capex-focused strategy: Higher investment in PP&E signals ongoing expansion—consistent with the rising rig count trend you pointed out earlier.

Liquidity Strengthening: Year-end cash and working capital improved, suggesting healthy cash flows or capital discipline.

Q4 Balance Sheet Ratios:

1) NBV: $2.58 USD

2) Current Ratio: 2.3x

3) Debt/Equity: 0.56x

4) Toal Liabilities/Total Assets: 0.26x

Income Statement:

📌 Q4 F2024 Summary – Record-Breaking Quarter

🚀 Performance Highlights

Record-high quarterly revenue, driven by:

New multi-year, multi-rig contracts in West Africa and Chile with tier-one miners.

Continued strong performance in Egypt, supported by a major underground contract.

Completion of operations in Mali, with successful redeployment of assets to nearby regions.

🌍 Strategic Expansion & Positioning

Positioned for sustained growth:

Ramp-up in core regions and expansion into new high-potential markets.

Leveraging gold price strength to drive exploration drilling demand and active tendering.

Saudi Arabia entry: Established a local entity to pursue contracts in 2025.

South America: Actively tendering new contracts following recent success.

Rig fleet expansion underway to meet rising demand.

🧠 Executive Commentary

CFO (Greg Borsk):

Growth underpinned by well-funded, top-tier clients across a diverse geographic footprint.

High gold prices and robust global exploration spend are major tailwinds.

CEO (Dave Harper):

2024 was a transformative year with a strategic pivot into lower-risk, growth markets.

Multi-year, multi-rig contracts will drive revenues through 2027+.

Fiscal 2025 will focus on growth, expansion, and shareholder value creation.

📌 Q3 F2024 Summary – Foundation for Long-Term Growth

📈 Operational & Financial Highlights

Strong revenue contribution from West Africa (Ghana & Côte d'Ivoire).

$150M+ contracts secured in 2024 to drive revenue/profitability through 2027.

Post-quarter wins:

$49M in Chile, including two major multi-rig, multi-year contracts.

Drilling also commenced in Peru and Chile post-Q3.

Egypt operations expanded, backed by a long-term underground contract.

Fleet upgraded for major new contracts; ended Q3 with 95 rigs.

Achieved 21 million LTI (Lost Time Injury)-free hours.

💸 Capex & Capital Allocation

Elevated capex front-loaded due to Chile contracts.

Though net cash positive, company carries debt at 9.3% interest.

Dividend not reinstated yet – focus is on growth capex and NCIB (share buyback).

Management hinted dividend will be “imminently reinstated,” but not immediately.Institutional investors are increasingly showing interest as share nears $3.

📊 Margins & Growth Outlook

Gross margin stable at 26% YTD (2023 & 2024).

New contracts to boost revenue starting Q4 2024 and through 2027.

Total of $199M in contracts ($49M Chile + $150M global) to be spread over 3–5 years.

🧠 Management Commentary

CFO (Greg Borsk): Transitioning rigs to more favorable jurisdictions is paying off, improving visibility and financial strength.

CEO (Dave Harper): Multi-rig, long-term contracts with tier-1 clients are creating predictable revenue and market leadership.

Outlook:

Geodrill Outlook – What’s Ahead

Geodrill has been working in West Africa for over 25 years, and it has heavily invested in building a strong fleet of drill rigs for the region. Thanks to this experience, its track record of safety, accuracy, and reliability, Geodrill continues to win new contracts and grow its revenue.

In 2024, Geodrill also kept busy in Egypt, Chile, and Peru, where it invested in new equipment to support large, long-term drilling contracts.

Geodrill has successfully expanded its client base to include:

Major mining companies

Mid-sized players (intermediates)

Smaller exploration companies (juniors)

However, because financial markets have been tough lately, more of Geodrill’s recent work has come from major and intermediate clients, who tend to have stronger funding.

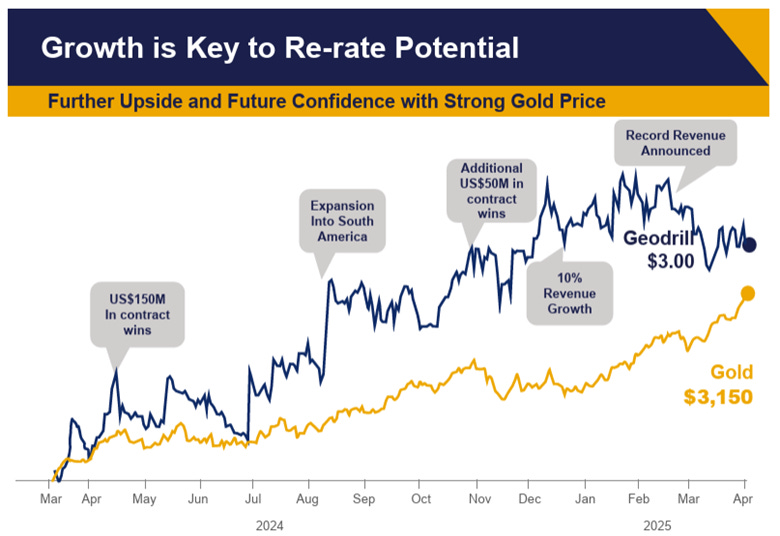

According to my forecast for FY25, GEO could generate $158 million in revenue and $34 million in adjusted EBITDA, driven by:

A) Strong Contracts Secured

In 2024, Geodrill signed several multi-rig, multi-year contracts, which are expected to bring in steady revenue and profit over the next 3 to 5 years.

B) Drill Rig Fleet Status

As of December 31, 2024, Geodrill had:

93 drill rigs total

86 rigs ready to work

5 in the workshop for maintenance

2 being shipped

Plus 2 rented rigs, bringing the fleet total to 95

As of March 1, 2025, Geodrill added one more rig, making it a fleet of 96 rigs in total.

Valuation:

Share price: $2.04 USD

Shares outstanding: 46.8M

Market Cap: $95M USD

EV: $99M USD

F24 Adjusted EBITDA: $31.1M USD

F25 Adjusted EBITDA: $33.1M USD

EV/F25 Adj EBITDA: 2.99x

Peers:

Orbit Garant @ $1.50/share – trading at 3.8x EV/F25 Adjusted EBITDA

Foraco @ $1.90/share – trading at 4.3x EV/F25 Adjusted EBITDA

Major Drilling @ $8.27/share – trading at 5x EV/F25 Adjusted EBITDA

Average: 4.36x

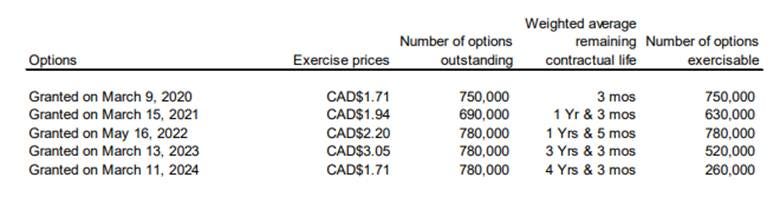

OPTIONS:

RISK:

1) Client Base and Revenue

Geodrill relies on a mix of short- and long-term contracts. There's always a risk that some deals may not be renewed, which could affect revenue.

In 2024, three clients made up 40% of revenue.

2) Geodrill’s Tax Dispute with Burkina Faso: Court Victory Under Appeal

In 2019, the tax authorities in Burkina Faso claimed that a company called Geodrill owed about $17.9 million in taxes and penalties for the years 2016 to 2018. A year later, they reduced that claim to $9.7 million.

The tax authority said Geodrill had a permanent presence in Burkina Faso and should be taxed accordingly. But Geodrill disagreed, saying it didn’t have a permanent base there and was instead operating as a foreign (non-resident) company. That means it believed it was already correctly taxed through a system where its clients in Burkina Faso paid a portion of its income to the government on its behalf.

In 2021, Geodrill formally challenged the tax authority’s claim in court. In early 2023, the court agreed with Geodrill, threw out the tax bill, and even awarded Geodrill some money to cover its costs.

However, the tax authority didn’t accept the decision and has appealed it. As of March 1, 2025, the courts haven’t responded to the appeal or set a date for a new hearing.

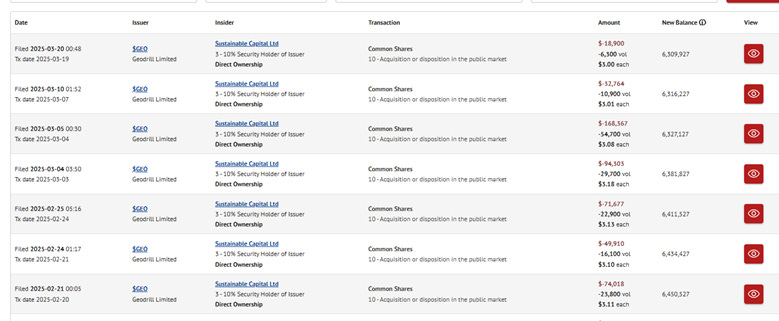

3) Sustainable capital has been consistently selling GEO’s shares they own and it is putting a lot of pressure on the share price

Management:

Board of Directors:

Stock Ownership:

Insider Ownership: 50%

Institutions: 22%

General Public: 29%

My Investment Decision:

I like the business and started buying around $2.50 during the pullback driven by tariff concerns. With rig counts increasing and management confident in achieving record revenue and adjusted EBITDA, I continue to hold the stock.

GeoDrill should be trading at a minimum of 3.5x to 4x EV/FY25 adjusted EBITDA, which implies a share price between $3.35 and $3.85.

With gold prices remaining strong—currently hovering around $3,300—and ongoing macroeconomic tensions, GeoDrill is well-positioned to continue benefiting.

Disclosure:

1. No compensation was received for the preparation of this report.

2. The information presented in this report is based on publicly available data and sources believed to be reliable. However, I make no guarantees regarding its accuracy or completeness.

3. This report is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research or consult a financial advisor before making investment decisions. All investments involve risk

4. I and my immediate families do not have any conflicts of interest with this company.

5. This report is for informational purposes only and does not constitute investment advice.