Innovotech (IOT.V) Tops the List for FY25 Investment Ideas

Accelerating Contract Research Demand and Scalable Infrastructure Set Stage for EBITDA Re-Rating in FY25

BUSINESS MODEL:

Innovotech Inc. is a Canadian biotechnology company specializing in antimicrobial solutions and biofilm research. Headquartered in Edmonton, Alberta, the company offers a range of products and services, including MBEC Assay® Kits for biofilm testing, contract research services for medical device companies, and the development of silver-based antimicrobial compounds like InnovoSIL™. Innovotech's expertise supports clients in regulatory submissions and product development across various industries. All in all, innovotech is involved in selling products to the medical research market, providing contract research services to entities performing biomedical research and performing research and development activities on its own proprietary compounds. The products are sold from Canada, and the services are performed in Canada to clients in Canada, the United States and Internationally.

MBEC Assay® Kits:

Innovotech develops and sells MBEC Assay® Kits, which are tools designed to test microbial biofilms. The MBEC Assay® Kit, developed and sold by Innovotech, is a crucial tool for testing the effectiveness of antimicrobial agents against microbial biofilms.

In other words, Imagine tiny germs, like bacteria or fungi. Sometimes, these germs can group together and form a sort of sticky, protective layer – think of the slimy feeling on a rock in a stream. This sticky layer is called a microbial biofilm. It's like a little fort for the germs, making them much harder to kill.

Now, antimicrobial agents are like special medicines or cleaning products designed to fight these germs. So, when we talk about "testing the effectiveness of antimicrobial agents against microbial biofilms," it means we're checking how well these germ-fighting substances can break down and kill those tough, sticky communities of germs. It's like testing how well a special cleaner can get rid of stubborn slime.

MBEC Assay Kits had a revenue of $0.23M in 2023 and $0.21M in 2024. Innovotech makes about 60 cents in profit for every dollar they make selling their Assay Kits. However, the sales of these kits have been slowly going down each year, and this will probably keep happening because there are other similar products out there. They haven't really tried hard to sell these kits before, but they are thinking about focusing on it this year because they hope that selling more kits will lead to more customers for their main research business.

Contract Research:

Innovotech generates majority of the revenue by providing medical device companies with independent scientific studies that are an important component of regulatory applications to the US FDA and other agencies. The company has worked with over 100 clients. The primary revenue source is fees charged to clients for conducting customized antimicrobial and anti-biofilm testing services.

Customized Testing Solutions: Innovotech specializes in developing in vitro models tailored to the specific needs of their clients' products and applications. They can design tests to assess anti-biofilm activity at various stages, from early-stage screening to regulatory claim validation and post-market comparisons.

Supporting Regulatory Submissions: A significant aspect of their service is assisting medical device companies with the testing required for regulatory approvals from agencies like the FDA. This rigorous testing is often a prerequisite for regulatory submissions to agencies such as the FDA in the United States and other regulatory bodies across the globe. Innovotech has established a strong reputation in this field, having supported over one hundred medical device companies in their efforts to gain market access for their products.

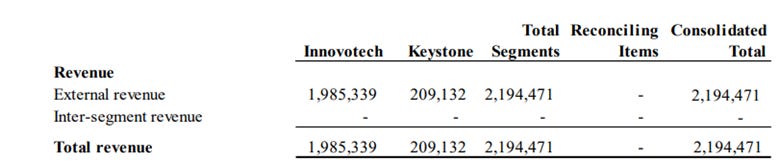

Innovotech's contract research services experienced significant growth, with revenues increasing from $0.9M in 2023 to $1.9M($0.2M from recent acquisition) in 2024. Innovotech reported strong client demand into 2025, which suggests that the increased revenue in 2024 was driven by a higher volume of projects and potentially larger contracts. Several large contracts from clients ramping up their testing activities contributed significantly to the revenue in 2024. These projects, which started in 2024, are expected to continue driving demand in 2025. To handle the growing workload, Innovotech expanded its laboratory space, increased staff by 25%, and invested in new equipment in 2025. This expansion indicates that the company was proactively preparing for and meeting the rising demand for its services. Keystone Labs acquired is expected to further boost contract research revenue in subsequent periods and it brings its own established customer base in the pharmaceutical, industrial, and biotechnology sectors.

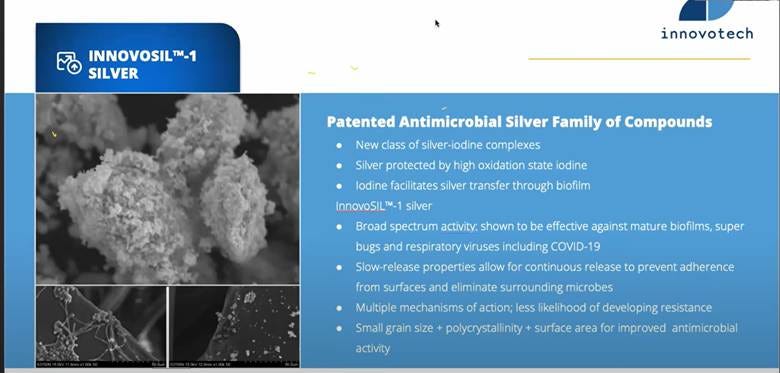

InnovoSil™-1 Silver:

InnovoSIL™-1 is a special silver-based material that kills bacteria. Innovotech owns this technology and is trying to bring it to market by teaming up with other companies or possibly selling products made with it themselves. They’ve figured out how to make it in larger batches while keeping it strong and pure.

Right now, companies are testing how well InnovoSIL™-1 works with their own medical products, like wound dressings or implants. It’s safe for use around blood and can handle sterilization (like with X-rays or special gases), which makes it ideal for healthcare. It also works with 3D printing, meaning it could be used to make advanced medical tools and materials.

If everything goes well, products using InnovoSIL™-1 could start hitting the market in 2025 or early 2026.

ACQUISITIONS:

Keystone Labs:

In October 2024, Innovotech Inc. acquired Keystone Labs, a service provider or CRO founded in 2005 that supports product development in the drug, industrial, and biotech sectors. The acquisition, which closed on November 1, 2024, was valued at $0.5 million, representing 0.5 times Keystone’s adjusted revenues of $1.2 million. Innovotech financed the purchase through a private placement. Keystone Labs is licensed by Health Canada to test drugs and related products, and its integration into Innovotech strengthens the company’s contract research capabilities and supports the development of its proprietary antimicrobial compound, InnovoSIL-1™.

As part of the acquisition, Innovotech established a new division called Innovotech Labs Corporation (ILC), which is certified to conduct high-precision bacterial testing on medical devices. This strategic move allows Innovotech to expand its laboratory services across Canada, particularly in the western regions. Keystone brings a Health Canada Drug Establishment License and a strong industry reputation, positioning Innovotech to grow further by working closely with regulatory experts and offering complementary services such as environmental contamination testing and stability assessments for products.

Overall, this segment of Innovotech is now engaged in providing analytical testing services for the pharmaceutical, medical device, biotechnology, and nutraceutical industries. All services are conducted within Canada, with nearly all clients based domestically.

Noulife Sciences:

Innovotech owns a 60% stake in Noulife Sciences, an intellectual property (IP) holding company focused on specialized antioxidant ingredients intended for use in skincare and select medical applications. While Noulife holds promising IP assets, it is not currently generating revenue, and Innovotech remains cautious regarding the timeline for further R&D developments. As such, Noulife is not expected to contribute materially in the near term. Innovotech continues to concentrate on its core business of pharmaceutical and health product testing, where it ensures compliance with quality and safety standards.

Financial Statements:

Balance Sheet:

Innovotech has a strong balance sheet. Shareholder equity has improved from $1M in Q1 F23 to $2.6M in Q4 F24. Also, the company has a current ratio of 3.98x and net book value of $0.05/share.

Income Statement:

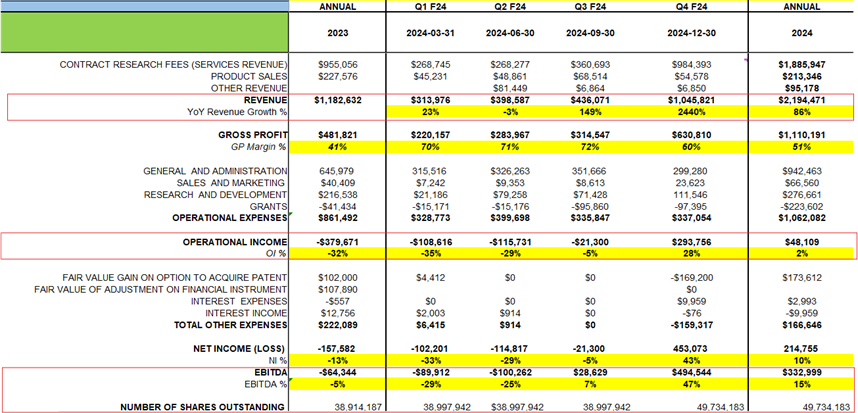

Full Year 2024 Highlights and Subsequent Events:

Service revenue nearly doubled to $1.89 million (up from about $955K in 2023). Most of that revenue still came from Innovotech’s original work, with KLI adding a smaller ($209K) but growing share.

Sales of MBEC Kits were $213,346, down slightly compared to last year and below the 5-year average.

Other income from partnerships and licensing was $95,178, compared to zero last year.

Gross profit margin rose to 50.6% (up from 40.7%), thanks to strong Q4 earnings while keeping fixed costs stable.

Adjusted EBITDA increased from -$0.1M in 2023 to $0.3M in 2024

2024 was a breakthrough year for Innovotech—revenues soared, the company grew fast, and it invested heavily in people, lab space, and equipment, all while getting support from government funding.

The significant increase in revenue and the profitability in 2024 reflect the Company’s strategic initiatives and the positive impact of the acquisition of Keystone Labs that will add to future growth and shareholder value through new markets, methodologies, and quality certifications.

Our strong balance sheet, with considerable growth in both assets and shareholders’ equity, supports our continued expansion and investment in future opportunities. The net income for the year translates to positive earnings per share, marking a significant turnaround from previous years, said Craig Milne, Innovotech CEO

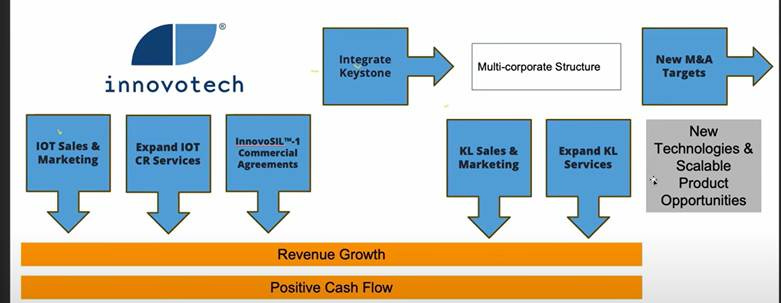

🔥 F25 Catalysts – Innovotech Positioned for Breakout Growth in 2025

Large Client Project Accelerates Demand:

A major client placed a large 2025 order to fast-track project timelines—reflects increasing reliance on Innovotech’s research capabilities.

Demand surge is sustained from major 2024 contracts, driving high visibility and backlog heading into 2025.

Operational Capacity & Infrastructure Expansion:

1,390 sq. ft. of new lab space added adjacent to existing facilities.

Combined with Keystone Labs (KLI), Innovotech now operates 13,089 sq. ft. of lab/office space—ready to handle growing project load.

Aggressive Talent Scaling to Meet Demand:

Headcount nearly doubled—even before including Keystone Labs staff.

Additional 25% team growth planned by Q1 2025, demonstrating confidence in long-term workload sustainability.

Doubling Analytical Power for Drug Testing:

Installed second HPLC system at Keystone Labs—doubling capacity for complex pharmaceutical analyses.

Large stability chamber also added, with full commissioning targeted for mid-2025, boosting throughput for long-term studies.

InnovoSIL™ Silver Strategy Expansion:

Exploring direct commercialization of silver-based antimicrobial products, not just licensing—potential to capture more margin and IP value.

Recent European patent granted for antimicrobial silver periodate coatings on polymers, strengthening global moat and licensing leverage.

New Subsidiary Launch Supports Growth:

Formed Innovotech Labs Corp. (ILC) to house high-growth verticals: contract research, MBEC™ kits, and silver commercialization.

Mirrors scalable structure of Keystone Labs, acquired in late 2024—creating operational leverage.

Board Strengthened for Strategic Execution:

Appointment of Brad Clark (CPA, CBV) adds deep experience in finance, M&A, and scaling—perfectly timed for upcoming growth initiatives.

Recurring Revenue & Deferred Payments:

New contracts structured with upfront + monthly payments—supporting cash flow stability.

Revenue Growth is the North Star:

Top-line expansion is the key priority.

Management eyes $10M revenue milestone (long term), pursuing product commercialization and new MD&A opportunities to support that goal.

Contract Research Tailwinds:

Strong growth in research services as clients scale studies for FDA approvals and advanced medical research.

Innovotech is rapidly becoming a trusted long-term partner for biotech and pharma clients.

Encrustation Testing: A New Frontier:

Developed advanced testing to understand mineral buildup on urinary catheters, especially with bacterial biofilms.

Introduced both static and dynamic catheter models; 2025 work expands to more bacterial strains.

Backed by NRC-IRAP funding, showing institutional support for its innovation.

MBEC® Assay Innovation with Duke University:

Collaborating to enhance bacterial biofilm testing using new plate designs for faster, more precise imaging and analysis.

Customized Testing Drives Differentiation:

Innovotech is validating custom assay methods tailored to client needs—positioning itself as a premium, flexible partner.

F25 and F26 Financial Forecast:

F25 assumptions:

Revenue trend assumes demand we saw in Q4 F24 to continue into F25

Gross margin of 60% achieved in Q4 F24 to continue into F25.

OPEX is expected to increase by 25% as per the management guidance to support the revenue growth, however I have baked in an increase of 28% in OPEX to be conservative

Valuation:

Share Price: $0.14 CAD

Shares Outstanding F24 (post financing): 50M

Market Cap: $7M

Enterprise Value: $6.2M

F25 Adjusted EBITDA: ~$1.4M

F26: Adjusted EBITDA: ~ 1.8M

EV/ F25 Adjusted EBITDA: 4.59x

EV/F26 Adjusted EBITDA: 3.5x

Relative Valuation:

Price Target:

In comparison to the valuation of the aforementioned healthcare and specialty pharmaceutical firms, a price target of $0.32 appears reasonable, implying a valuation of 11.1x FY25 EV/EBITDA and 8.5x FY25 EV/EBITDA

Nov 2024 Financing Details:

Non-brokered financing round with $1,150,000

1 common share priced at $0.13, warrants at $.17: 12-month expiry

Three investor groups are shown:

SCD- Small Cap Discoveries (likely a strategic investor) – in yellow

Outside investors – in dark blue

Inside investors (likely management or existing shareholders) – in light blue

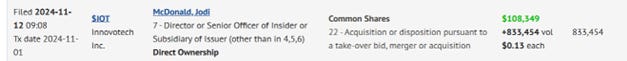

Following were the insiders who participated in the financing:

McDonald didn’t participate in the financing directly - she acquired shares in exchange for Keynote (as vendor) and became an insider as a result.

McDonald didn’t participate in the financing directly - she acquired shares in exchange for Keynote (as vendor) and became an insider as a result.

Board of Directors:

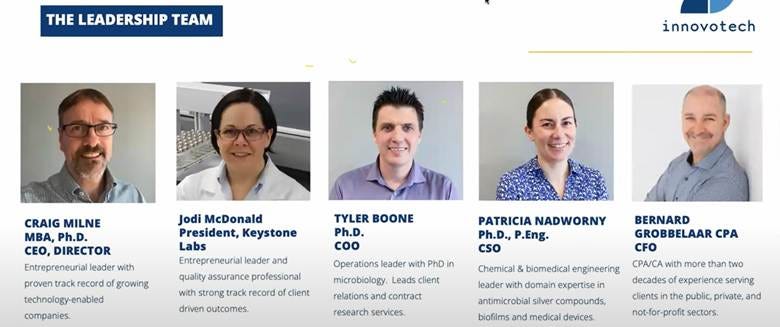

Leadership Team:

Insider Ownership:

Individual Insiders: 41%

General Public: 59%

Conclusion:

I firmly believe this company is undervalued and poised for growth, driven by its recent acquisition and strong revenue demand from existing clients, as evidenced in Q4 and expected to continue into FY25. From a valuation standpoint, the business appears attractively priced compared to its peers. For these reasons, I initiated a position in the company at approximately $0.14.

Disclosure:

1. No compensation was received for the preparation of this report.

2. The information presented in this report is based on publicly available data and sources believed to be reliable. However, I make no guarantees regarding its accuracy or completeness.

3. This report is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research or consult a financial advisor before making investment decisions. All investments involve risk

4. I and my immediate families do not have any conflicts of interest with this company.

5. This report is for informational purposes only and does not constitute investment advice.

Please check our small cap discoveries channel on YouTube. They have a good following. They participated in financing and also conduct interviews of public companies.

Could you please tell me what the following refers to?

"Three investor groups are shown:

SCD- Small Cap Discoveries (likely a strategic investor) – in yellow

Outside investors – in dark blue

Inside investors (likely management or existing shareholders) – in light blue"