Q4 F24 (2024-12-31) EARNINGS REVIEW:

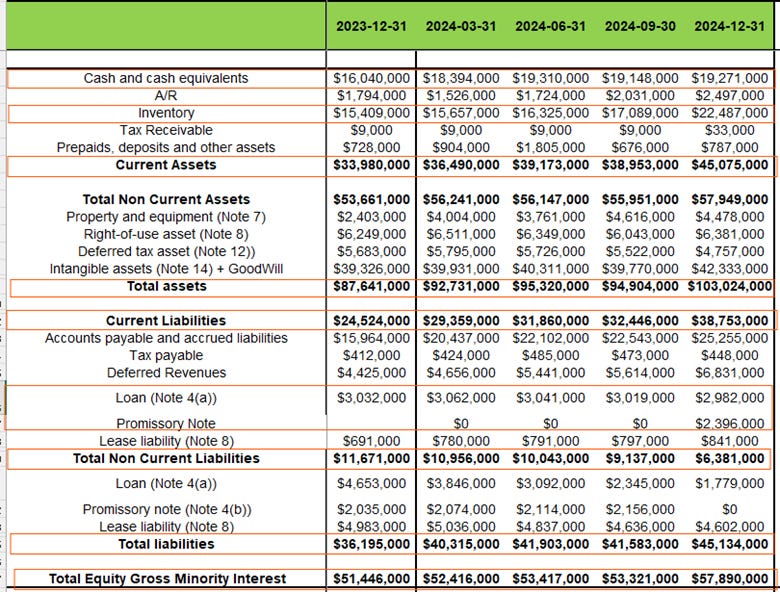

BALANCE SHEET:

Starting with the balance sheet and analyzing the trend over the last five quarters, current assets have increased from $34M to $45M, primarily driven by improvements in cash and inventory. This growth has ultimately boosted total assets from $88M in Q4 FY23 to $103M in Q4 FY24.

On the liabilities side, current liabilities have risen from $25M to $39M, mainly due to an increase in accounts payable. Meanwhile, non-current liabilities have declined from $12M to $6M, largely driven by a reduction in debt, which has decreased from $10M to $7M. The management remains on track to fully pay off the remaining debt.

Overall, I find the balance sheet strong. The current ratio stands at 1.16x, the company has no significant long-term debt, and shareholder equity is trending in a positive direction—rising from $51M in Q4 FY23 to $58M in Q4 FY24, reflecting a 12.5% year-over-year improvement.

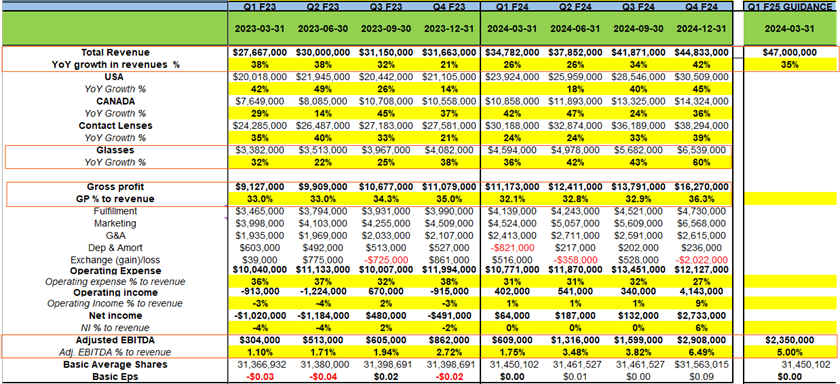

INCOME STATEMENT:

I was impressed with Q4 FY24—revenue, gross margin, and adjusted EBITDA all exceeded my expectations. Revenue surged 42% YoY, fueled by outstanding growth in both the U.S. and Canada.

In the U.S., revenue has grown from $20M in Q1 FY23 to $31M by Q4 FY24, reflecting a quarterly compounded growth rate of 5.63%. Meanwhile, Canadian revenue climbed from $8M in Q1 FY23 to $14M by Q4 FY24, boasting a quarterly compounded growth rate of 7.25%.

YoY improvement in contact lenses by 39% was driven by driven by KITS Dailies and KITS Colored Dailies. YoY improvement in glasses business is driven by Introduction of smart glasses (KITS Pangolin), launch of KITS+ glasses membership, expansion of designer frames, etc.

The company delivered a record adjusted EBITDA of $2.9M—the highest in the last eight quarters—driven by a stellar 36.3% margin.

First Quarter 2025 Outlook

For Q1 2025, KITS management projects revenue between $46M and $48M, with adjusted EBITDA margins between 4% and 6%. My estimate lands at $47M, reflecting 35% YoY revenue growth, and an adjusted EBITDA of $2.4M (5% of revenue).

Key Points from the earnings call:

Growth & Performance

Over 60% year-over-year growth in the glasses segment.

Continued strength in contact lenses, driven by KITS Dailies and KITS Colored Dailies.

Autoship subscription program boosted repeat revenue and customer loyalty.

63% of Q4 revenue came from existing customers.

79,000 new customers in Q4, contributing to a record $16.6M in revenue (+$6.1M YoY).

Digital progressive glasses and lens upgrades up over 60% YoY.

Revenue to be in the range of $46 million to $48 million, with Adjusted EBITDA as a percentage of revenue between 4% and 6%.

Key Product & Innovation Launches

Q1: Expanded digital progressives ($28-$38 price range) and breakthrough influencer marketing.

Q2: Virtual try-on tool surpassed 1M sessions; launched KITS Daily contact lenses; API-led partnership with TELUS Health.

Q3: Introduced smart glasses (KITS Pangolin); expanded KITS contact lenses to color; launched KITS+ glasses membership.

Q4: Expanded designer frames; launched KITS PIXA customizable frames.

Customer Experience & Market Positioning

Served over 300,000 new customers in 2024.

Ensuring customers can find & purchase glasses/contact lenses in under 5 minutes.

Most prescription lenses & frames priced under $50.

Orders delivered in 1-2 days.

Tariffs & Cost Management

No anticipated impact from tariffs; alternative sourcing strategies in place.

Expecting stable costs with minimal disruption.

Consumer Trends & Market Insights

Customers prioritizing quality, value, and innovation.

Vision care remains a non-discretionary expense.

Growing demand for convenience and affordability in eyewear.

2025 Outlook & Financial Strategy

Focus on acquiring high-value customers with best margins.

No major CapEx or costly marketing campaigns planned.

EBITDA margin guidance: 4%-6% for 2025.

Continued investment in influencers and organic word-of-mouth marketing.

Improving operational efficiencies in fulfillment and G&A.

Debt reduction nearly complete (<$5M remaining).

Potential for stock buybacks as best use of capital.

TELUS Health Partnership & Insurance Expansion

Insurance business growing (up 200%).

Expansion plans for the U.S. in 2025.

Product & Pricing Strategy

Expanded selection of affordable glasses ($28-$48 price points).

Titanium rimless glasses introduced, offering 90% savings vs retail.

Lens upgrades (thinner lenses, blue-light filters, digital progressives) up over 60% YoY.

Focus on broad selection with lean inventory management.

Summary

Strong revenue growth driven by customer retention and innovation.

No anticipated material financial headwinds from tariffs or market conditions.

Continuing strategic expansion while maintaining operational efficiencies.

Positive outlook for 2025 with strong customer acquisition and retention strategies.

KPIs:

2 Year Active Customers:

New Customers:

Summary:

The numbers are undoubtedly trending in the right direction. As for my thoughts on valuation—including the price at which I’m buying—I've shared a detailed KITS deep dive research report here, which is available for those interested in a deeper analysis.