Navigating the Road Ahead: A Resilient Look at ZOOMD's Potential Paths - $ZOMD.V

Base case vs. worst case scenario for ZOMD

In my previous post, I shared my insights on F24 results vs. forecast which can be found here. Given the current market decline driven by recession concerns, ZOMD has experienced a decrease in investor interest. So, let’s take a closer look at what the worst-case scenario might look like for ZOMD?

Note: I’m maintaining my base case forecast (mentioned at the end of this article), but as an investor, I’m curious to explore what the valuations and financials might look like if the base case scenario doesn’t materialize.

That said, this isn’t financial advice, a stock recommendation, or an attempt to convince anyone to load up on shares. It’s simply my personal take on where I believe Zoomd is heading. These are my opinions based on my research and observations, not statements from Zoomd’s management.

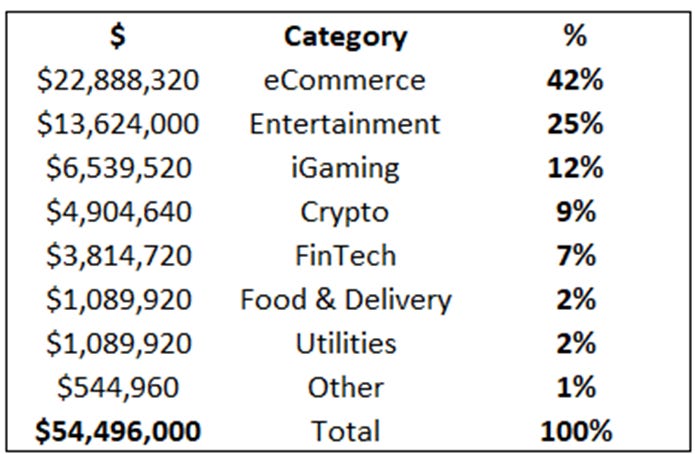

ZOOMD Technologies recently reported its F24 results and provided an update on revenue by category. Here’s a look at the breakdown:

What does it mean in terms of numbers? Below is the revenue breakdown by industry in US dollars:

I estimate that 42% of ZOMD's revenue from e-commerce is mainly generated by Shein. It's reasonable for investors to be concerned about Shein, as it’s based in Asia and could be a significant risk factor due to macro economic headwinds (tariffs). Let’s assume that out of $23M in revenue generated from e-commerce, 50% is derived from North America, which amounts to $11.5M or $3M/quarter, and assume that this portion is at full risk.

To be cautious, let’s reduce the revenue forecast by $3M(e-commerce risk) for Q2 F5-Q4 F25, as Q1 is already complete, and the company has indicated during the Q4 earnings call that they expect to maintain consistent net income and revenue growth. I’m comfortable with my Q1 projections.

Let’s also factor in the potential impact of a recession, with companies possibly cutting budgets or reducing spending. Considering this, let’s lower each quarter’s forecast by an additional $2M revenue. This results in an average reduction of $5M ($3M from e-commerce and $2M additional recession risk) per quarter from Q2 F25 to Q4 F25.

Additionally, ZOMD has announced new customer acquisitions in Q1, which I have not factored into my fiscal 2025 forecast yet, as I don’t know how those acquisitions will affect the numbers. Since clients are multibillion clients, I do expect budgets to be high, however, I don’t know what the number is and the company hasn’t guided budgets. These new customers could potentially exceed my conservative worst-case scenario mentioned below.

Revenue Projections:

Q1: $15M USD – 69% YoY Growth

Q2: $9M USD (reduction of $5M from last year; $3M USD driven by e-commerce revenue to North America and an additional $2M cut in revenues) – overall 36% revenue reduction vs. last year

Q3: $12M USD (reduction of $5M from last year; $3M USD driven by e-commerce revenue to North America and an additional $2M cut in revenues) – overall 30% revenue reduction vs. last year

Q4: $10M USD (reduction of $5M from last year; $3M USD driven by e-commerce revenue to North America and an additional $2M cut in revenues) – overall 33% revenue reduction vs. last year

F25: $46M total revenues, a YoY decline of 16% vs. F24

At $46M revenue, 39% gross margin % or $18M of gross profit and $12M annual OPEX, ZOMD should generate $6M in operating income, $6.8M adjusted EBITDA and $4M additional cash to the business. So, what does my forecast mean from a valuation perspective:

Share price: $0.35 USD

Shares: 99M

Market Cap: $34M USD

F25 Cash: $13M ($9M USD as of Q4 F24 and $4M additional cash expected to generate in F25)

Debt: No debt

EV: $23M USD

F25 Net Income: $5.4M USD

F25 Adjusted EBITDA: $6.8M USD

F25 cash: $13M USD

EV/Adjusted EBITDA: 3.36x

EV/Net Income: 4.3x

Market cap/cash: 2.6x

For those of us who remain confident in the management team, I believe they are dedicated to delivering the best results, as they have shown in the past three quarters. With over 100% revenue growth and an expanding customer base, the company appears to be on the right track. As I mentioned in my previous article, 80% of their new clients are acquired through word of mouth. The company has proven the value of its technology, and now it is starting to see the benefits. Has the share price pulled back more than it should have, I think yes. Even after the worst case scenerio, the business is trading at 3.3x F25 EV/EBITDA at .48/share CAD which is an extremely cheap multiple for an adtech company that doesn’t generate money from showing ads or based on views like other ad-tech companies, but by acquiring clients for their customers.

From a technical standpoint, I think the business has reached its long term support at .48 cents. It is an important support to watch for. It has also hit 30 RSI which is an oversold indicator from a technical standpoint

We have chatted about worst case scenario for ZOMD above, let’s chat about base case scenario which I shared in March 2025.

I forecasted $69M revenue and $14.6M adjusted EBITDA revenue driven by:

✅ New clients announced in Q1 F25

✅ Increased budgets from existing clients

✅ Potential new client announcements

If my base case guidance came true, this business is trading at EV/F25 Adjusted EBITDA: 1.6x at $0.48 CAD share price

Conclusion:

As an investor, my forecast is based on observed trends, insights from the earnings call, and analysis of historical results. Ultimately, it's up to you to determine where ZOMD will end up. I continue to hold and average down wherever I find opportunities like today. I wish your hard earned money help you to generate wealth. If you found value in this article, I’d be grateful if you considered subscribing. Your support helps me keep sharing insights like this

Good luck to all the long-term investors! Happy investing!

Thank you to all the readers for taking the time to read and engage with this post. Your support and interest mean a lot! Wishing you all the best in your investment journeys

Thanks for the article. certainly looks cheap even on a downside scenario basis.

I struggle to understand what their business does different than other adtech firms that has enabled them to grow substantially in the past year? Is that advantage sustainable and are the revenues sticky?