Neupath Health Inc. $NPTH.V - Deep Dive Research Report # 23

NeuPath Health Inc.: Navigating the Chronic Pain Management Landscape with Strategic Growth and Operational Efficiency

Business Model:

NeuPath Health Inc. (TSXV: NPTH) is a Canadian healthcare company specializing in chronic pain management services. The company provides comprehensive pain assessment and multi-modal treatment plans aimed at helping patients manage pain and improve their quality of life. NeuPath operates an interdisciplinary network of medical clinics in Ontario and Alberta and offers independent medical assessments through a national network of healthcare providers.

Lines of Business:

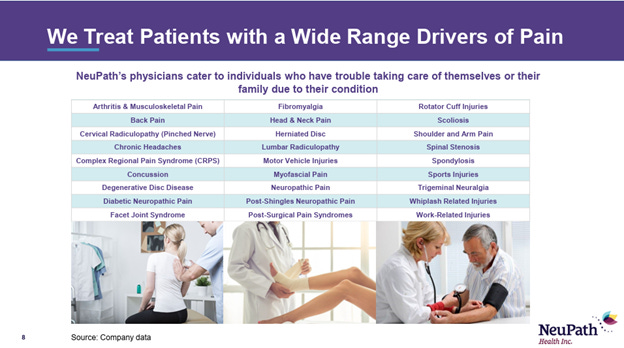

1) Multidisciplinary Care:

NeuPath operates a network of medical clinics in Ontario and Alberta that provide comprehensive assessments and rehabilitation services to clients with chronic pain, musculoskeletal/back injuries, sports related injuries and concussions. NeuPath’s healthcare providers cover a broad range of specialties and include: Physiatrists, Neurologists, Anesthesiologists, Orthopedic Surgeons, General Practitioners with specialized training in chronic pain, as well as Medication Management Physicians, Athletic Therapists, Psychotherapists, Dietitians, Nurses and other allied health practitioners.

NeuPath also provides workplace health services and independent medical assessments to employers and disability insurers through a national network of healthcare providers, including: Cardiologists, Dentists, Dermatologists, Endocrinologists, Psychiatrists, Gastroenterologists, General Practitioners, Internal Medicine, Specialists, Neurologists, Neuropsychiatrists, Neuropsychologists, Occupational Therapists, Ophthalmologists, Orthopedic Surgeons, Physiatrists, Physiotherapists, Psychologists, Respirologists and Rheumatologists.

NeuPath generates revenue by providing both insured and uninsured services to patients. Insured services include treatments or procedures covered by provincial health plans and third-party health insurance plans. In most cases, the insurer is billed directly by NeuPath. Uninsured services include medical assessments, workplace health services and treatments and procedures that are not covered by provincial health plans or third-party health insurance plans and are billed directly to patients.

2) Research:

Through a wholly owned subsidiary, NeuPath provides contract research services to pharmaceutical companies. More importantly, these clinical research capabilities allow the Company to evaluate the efficacy of new and existing services and treatments. On April 11, 2023, the findings of a 562-patient study focused on chronic pain and the impact of NeuPath’s treatments on patients’ lives was published in the online journal Cureus(1). The study participants, who previously reported low levels of functioning across several daily life activities, experienced significant improvements in all measured daily life activities after undergoing NeuPath’s interdisciplinary treatment. The results of this study present an exciting opportunity for NeuPath to improve the quality of life for patients by applying cutting-edge and research-driven best practices.

Markets:

The Company competes in the chronic pain, sports medicine, concussion and workplace health services markets in Canada. Conditions often coexist amongst these distinct markets, for example, chronic pain is one of the known consequences of a traumatic brain injury. NeuPath believes that having the ability to treat these often-coexisting conditions and building collaborative, interdisciplinary teams of healthcare providers are distinct competitive advantages and are important foundations for improving patient care.

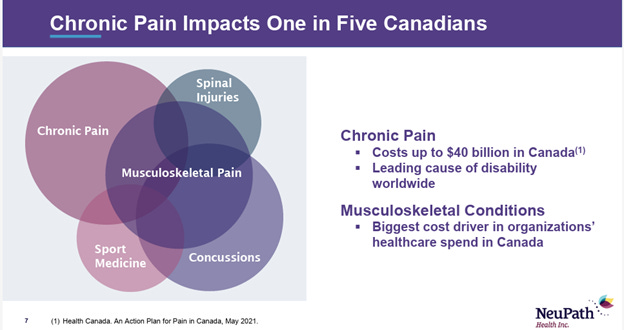

Chronic Pain:

According to the Global Burden of Disease Study, chronic pain is the 4th most burdensome disease or condition impacting approximately 1 in 5 adults worldwide. Despite chronic pain’s prevalence and impact, it has only recently started to attract increased attention. In May 2019, the World Health Organization, for the first time, added chronic pain to its International Classification of Diseases. The International Classification of Diseases is used worldwide as a diagnostic tool to classify causes of injury or death and the addition of chronic pain will allow for better tracking of the impact and prevalence of chronic pain. In addition, the Canadian federal government formed the Canadian Pain Task Force in March 2019 to assess how chronic pain is currently managed and make recommendations for improvement. Both of these initiatives have increased attention on chronic pain. The chronic pain market in Canada was valued at approximately CAD 3.01 billion in 2023 and is projected to reach around CAD 4.63 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.71%.

Sports Medicine:

According to a 2015 report by Parachute, injuries in sports and physical activity cost the Canadian healthcare system nearly $1.5 billion annually.

Concussions:

Recently, concussions or traumatic brain injuries have gained prominence mainly due to research and improved understanding around chronic traumatic encephalopathy and its connection to head trauma. The Cost of Injury in Canada study, released in 2015, estimated the cost of head injuries in sports and recreation at $1.0 billion per year in Canada.

Workplace:

Health Services Spending on employee benefit group life and health plans in Canada was estimated to be $46.1 billion in 2019, with $21.9 billion spent on medical benefits(6). A significant portion of this cost is allocated to traditional benefits like medical, dental and life/AD&D. According to a recent report by the Conference Board of Canada, healthcare costs in Canada are expected to increase substantially over the next decade due to an aging population, combined with population growth and the impact of COVID-19(7). Without substantial increases in public funding, Canadians could experience a reduction in access to care and employers could see a corresponding increase in lost productivity.

A study completed by Deloitte in 2019 found that employers are increasingly aware that conditions like mental illness are costly for employers(8). As a result, some employers are investing in workplace mental health initiatives and, more importantly, are generating a positive return on investment. Based on early experiences with workplace mental health initiatives, employers may look to implement other workplace health initiatives to address conditions like pain that impact absenteeism, presenteeism and reduce short-term and/or long-term disability.

Network:

NeuPath Health Inc. operates a total of 15 clinics across Canada. This includes 12 locations in Ontario and 3 in Alberta.

Total Square footage:

At the end of F23, the total square footage of all facilities was 91K. By the end of F24, it had been reduced to 69.5K as the company aims to eliminate unused space. The company is continuing to reduce its footprint as leases expire. This year, it will finalize all leased spaces as contracts come up for renewal to improve utilization efficiency.

Competitors in Canada:

1. WELL Health Technologies Corp. (TSX: WELL)

WELL Health owns and operates a portfolio of primary healthcare facilities and provides digital health solutions. Their services include telehealth consultations, electronic medical records (EMR) services, and allied health services, which may encompass aspects of pain management.

2. Andlauer Healthcare Group Inc. (TSX: AND)

Andlauer specializes in supply chain management services for the healthcare sector, including transportation and distribution of medical products. While not directly providing pain management services, their operations support companies that do.

3. Extendicare Inc. (TSX: EXE)

Extendicare offers long-term care services, retirement living, and home healthcare services across Canada. Their healthcare services may involve managing chronic conditions, including pain management, for their residents and clients.

4. Chartwell Retirement Residences (TSX: CSH.UN)

Chartwell operates retirement and long-term care residences in Canada. Similar to Extendicare, they provide healthcare services that may include aspects of pain management for their residents.

5. Medical Facilities Corporation (TSX: DR)

Medical Facilities Corporation owns surgical facilities in the United States and Canada, offering a range of services, including pain management procedures. Their focus on surgical interventions positions them as a potential competitor in the broader pain management landscape.

It's important to note that while these companies operate within the healthcare sector and may offer services related to pain management, none specialize exclusively in chronic pain management like NeuPath Health Inc. Investors should consider the specific services and market focus of each company when evaluating potential competitors.

Key Performance Indicators:

Capacity Utilization %:

Increased capacity utilization - The Company’s focus is to generate revenue growth by improving capacity utilization at its existing medical clinics. To achieve this objective, the Company intends to continue adding complementary services and healthcare provider hours, with a focus on improving patient throughput.

Net Debt (includes lease + Bloom Burton + Interest Bearing Debt):

In quarterly result press release, Neupath reported net debt; however, it does not include debt from Bloom Burton or interest-bearing debt, which I have disclosed below. The company has been effectively reducing net debt by eliminating unused space, thereby lowering lease obligations.

Historical Financial Analysis, F25 Financial Projection, Valuation vs. Peers, and My Investment Decision:

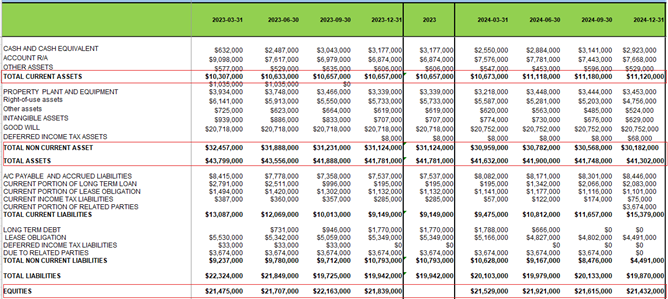

Balance Sheet:

Neupath announced on March 27th that it has repaid $3.7M amount due to bloom and burton (thanks to them for lending money to NeuPath at 0%) and it has also paid debentures $1.4M of debentures. Excluding $5.1M from current assets mentioned in Q4 F24, current ratio stands at 1.1x which is decent. Neupath’s cash balance has been growing and total liabilities have been stabilized so the company is focusing on improving share holder equity.

Income Statement:

Q4 F24:

Strong Growth & Investments

• NeuPath continues to deliver organic growth while investing in facilities.

• New procedures (e.g., Arthrosamid) and a new Credit Facility will accelerate expansion.

Arthrosamid Injection Milestone

• In Q1 2025, NeuPath performed the first-ever Arthrosamid (2.5% iPAAG) injection in North America at its Mississauga clinic.

• Arthrosamid is a unique hydrogel injection for osteoarthritis, reducing knee pain with a single dose.

$13.5 Million Credit Facility

• In Q1 2025, NeuPath announced a $13.5M Credit Facility with National Bank.

• The facility includes a Term Loan, a Revolving Facility, and an Acquisition Line to support business growth.

Clinic Revenue Growth

• Q4 2024 revenue: $17.5M (vs. $15.3M in Q4 2023).

• Full-year 2024 revenue: $67.3M (vs. $61.0M in 2023).

• Growth driven by increased fluoroscopy revenue and higher patient volumes.

Gross Margin Improvement

• Q4 2024 gross margin: 19.2% (same as Q4 2023).

• Full-year 2024 gross margin: 19.0% (vs. 18.6% in 2023).

• Improvement due to higher fluoroscopy revenue and increased patient volumes.

Q3 F24:

1. The increase in clinic revenue for the three and nine months ended September 30, 2024 was primarily due to stronger revenues from fluoroscopy and increased patient volumes from existing medical clinics. In my opinion, over 95% of the patients are insured either by their employer or from provincial/federal government of Canada.

2. Margin: NeuPath retains 30% for overhead, while doctors keep 70%. The total margin of 19% is influenced by varying margins across different facilities and the distinct margin structure of the non-clinic revenue segment.

3. Capacity utilization was 73% and 74% in the three and nine months ended September 30, 2024 compared to 65% and 67% for the three and nine months ended September 30, 2023. The improvement in capacity utilization was primarily driven by increased patient volumes and efficiency through continued optimization of clinic space, including the relocation of its Mississauga facility and corporate office space in August 2024, further reducing its clinic footprint

Q2 F24:

1) The increase in clinic revenue for the three and six months ended June 30, 2024 was primarily due to stronger revenues from fluoroscopy and increased patient volumes from existing medical clinics.

2)Capacity utilization was 77% and 75% in the three and six months ended June 30, 2024 compared to 70% and 68% for the three and six months ended June 30, 2023. The improvement in capacity utilization was primarily driven by increased patient volumes and efficiency through continued optimization of clinic space.

3) Gross margin % was 20.0% and 19.3% for the three and six months ended June 30, 2024 compared to 18.8% and 18.4% for the three and six months ended June 30, 2023. The increase in gross margin was primarily driven by higher revenues from fluoroscopy and increased patient volumes from existing medical clinics compared to the comparative three and six-month ended June 30, 2023.

Q1 F24:

1) Total revenue was $17.5 million for the three months ended March 31, 2024 compared to $16.1 million for the three months ended March 31, 2023, up 9% compared to the first quarter of 2023, delivering record first quarter revenues

2) For the three months ended March 31, 2024, capacity utilization improved to 72%, up from 65% in the first quarter of 2023

3) Gross margin % was 18.5% for the three months ended March 31, 2024 compared to 18.0% for the three months ended March 31, 2023. The increase in gross margin was primarily driven by higher revenues from fluoroscopy compared to the comparative quarter.

F25 drivers behind EBITDA forecast:

I believe the business is moving in a positive and promising direction. I have projected a year-over-year growth of 8.5% and an adjusted EBITDA of 5.65% of total revenue.

A) Enhancing Capacity Utilization – The company aims to improve operational efficiency by optimizing doctors’ time and productivity, thereby increasing overall capacity utilization.

B) Lease Portfolio Optimization – With several leases up for renewal, the company is proactively negotiating lease terms to incorporate tenant improvement costs as part of occupancy expenses. Given the capital-intensive nature of the business, strategic adjustments are being made to the lease portfolio, which is undergoing a significant reduction. Notably, 10 years ago, these locations were owned by various landlords, whereas the current renewal process provides an opportunity for more structured lease agreements.

C) Strategic Expansion Approach – Rather than establishing new locations from the ground up, the company is prioritizing the acquisition of existing facilities with an established client base. This approach allows for a more efficient expansion while leveraging operational synergies.

D) Growth Strategy: NeuPath's growth strategy includes expanding its physician network, broadening service offerings, opening new locations, and acquiring existing clinics to improve patient access across Canada. The company is exploring adjacent markets, leveraging its brand and operational strengths. Currently, 20% of Ontario markets are covered, with only three locations in Alberta. Expansion plans include sites in Calgary, Vancouver, and Victoria. New services such as imaging and orthopedic surgery are also being introduced.

Valuation:

Share price: $0.21 CAD

Shares Outstanding: 56.3M

Market Cap: $10.7M

EV: $20.3M (Market Cap $11.8M + $8.5M Net debt)

F25 Adjusted EBITDA: $4.5M

F24 Adjusted EBITDA: $3.8M

EV/ F25 Adj. EBITDA: 4.6x

EV/ F24 Adj. EBITDA: 5.4x

I think the company is trading at a reasonable multiple with a growth rate of 5% to 10% annually.

Related Party Transaction:

As mentioned above in balance sheet section, Bloom and Burton debt has been repaid.

Options:

Warrants:

Share buybacks:

Haywood has been repurchasing the company's shares in accordance with its directives. The company believes that its current valuation presents a more cost-effective opportunity compared to acquiring pain management facilities at a higher multiple.

Insider Ownership

Insider ownership: 30% Bloom Burton Investment Group and 2% is owned by the management

Management:

Conclusion:

This business operates in a recession-resistant sector, free from tariff-related concerns, and has demonstrated consistent growth within the 5%-10% range. Given these factors, it presents a reasonable investment opportunity in the price range of $0.16 to $0.18 per share. While the business may be perceived as relatively low-profile, it holds intrinsic value for investors seeking stability.

Disclosure:

1. No compensation was received for the preparation of this report.

2. The information presented in this report is based on publicly available data and sources believed to be reliable. However, I make no guarantees regarding its accuracy or completeness.

3. This report is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research or consult a financial advisor before making investment decisions. All investments involve risk

4. I and my immediate families do not have any conflicts of interest with this company.

5. This report is for informational purposes only and does not constitute investment advice