QUIPT HOME MEDICAL CORP (QIPT) - Deep Dive Research Report #17

A Cautious BUY: Attractive Valuation, Weakening Growth, and Acquisition Potential

Overview:

Quipt Home Medical is a leading provider of in-home clinical respiratory care in the U.S., offering comprehensive, technology-driven solutions for patients with respiratory and chronic conditions. Their services include specialized care and equipment for conditions like sleep apnea, pulmonary diseases, mobility challenges, and chronic disease management. Quipt focuses on enhancing patient care while raising healthcare standards. It is the 5th largest HME provider in the country headquartered in Wilder, Kentucky with 135 locations and over 1,200 employees

Products and Services:

Sleep Apnea and PAP Treatment:

Quipt simplifies sleep apnea testing at home with mail-in kits reviewed by certified doctors. They also provide PAP devices to help manage sleep apnea efficiently.

Home Ventilation:

Quipt offers home ventilation equipment, including masks and ventilators, to support breathing issues, helping patients maintain independence and normal daily activities.

Equipment Solutions:

They provide a range of mobility aids like wheelchairs and walkers, tailored to individual needs, improving patient mobility and overall well-being.

Daily and Ambulatory Aids:

Quipt offers products for independent living, such as walking aids, sleep solutions, and bathroom aids, to enhance comfort and safety.

Powered Mobility:

Specialized powered wheelchairs are available, with assessments and insurance support to ensure the right fit for each patient.

Respiratory Equipment Rental:

Quipt offers BiPAP and CPAP machine rentals with flexible terms, ensuring access to high-quality equipment for short-term or long-term needs.

Oxygen Therapy:

They provide personalized oxygen therapy solutions, customizing treatments to improve health outcomes and reduce hospital readmissions.

Lines of Business:

Rental of Medical Equipment:

This is a key source of recurring revenue, where Quipt rents out equipment like oxygen concentrators, CPAP machines, and other medical devices. This model provides a steady, predictable stream of income through monthly rental payments from patients or insurance providers.

Sale of Medical Equipment:

In addition to renting equipment, Quipt also sells medical devices directly to patients, hospitals, or healthcare providers. This includes both durable medical equipment (such as wheelchairs and hospital beds) and respiratory devices, generating one-time revenue through these sales.

These two segments combine to create a diversified revenue base, with rental income offering stability and long-term customer relationships, while equipment sales provide opportunities for larger, more immediate revenue.

Industry Forecast:

Overall Market Growth: The U.S. home medical equipment market was valued at approximately USD 13.33 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030.

Durable Medical Equipment Segment: Specifically, the home durable medical equipment segment is estimated to reach USD 13.33 billion in 2023, with a projected CAGR of 6.2% from 2024 to 2030.

Competitors and Valuations:

Here are some publicly traded companies that are competitors of Quipt Home Medical in the home medical equipment and respiratory therapy sector:

Lincare Holdings Inc. (Acquired by Linde Plc):

Lincare is a major player in the respiratory therapy services market, offering oxygen therapy, sleep therapy, and other home medical equipment.

Lincare Holdings Inc. was acquired by Linde Plc in a deal valued at $4.6 billion. The acquisition took place in 2012, with Linde acquiring the company to strengthen its healthcare division, particularly in the respiratory therapy market. The deal was structured as an all-cash transaction at $41.50 per share.

The EV/EBITDA multiple for the acquisition of Lincare Holdings Inc. by Linde Plc in 2012 was approximately 9.5x.

2. Rotech Healthcare Inc:

Rotech provides home medical equipment and services, specializing in respiratory therapy and other durable medical equipment.

Rotech Healthcare Inc. was acquired by Owens & Minor for $1.36 billion in cash, representing a 6.3x multiple of its last twelve months (LTM) EBITDA.

3. Apria Healthcare:

Apria is a provider of home respiratory therapy services and medical equipment, including oxygen therapy and sleep apnea products.

Apria Healthcare was acquired by Owens & Minor in a deal valued at $1.6 billion in 2021. The EV/EBITDA multiple for this acquisition was approximately 10x.

4. CareTrust REIT, Inc. (CTRE):

A real estate investment trust that owns and operates healthcare properties, including those that provide home medical equipment and rental services.

Trading at TTM EV/EBITDA of 24x

5. Medtronic plc (MDT)

Medtronic provides a wide array of medical devices, including those used in home healthcare and respiratory therapy.

Trading at TTM EV/EBITDA of 16x

6. Teleflex Incorporated (TFX)

Teleflex offers home medical equipment related to respiratory therapy, including ventilators and other critical care equipment.

Trading at TTM EV/EBITDA of 15x

7. ResMed Inc. (RMD)

ResMed is a global leader in sleep apnea equipment and offers related home medical equipment, including CPAP devices for sleep disorders.

Trading at TTM EV/EBITDA of 21x

Key Performance Indicators:

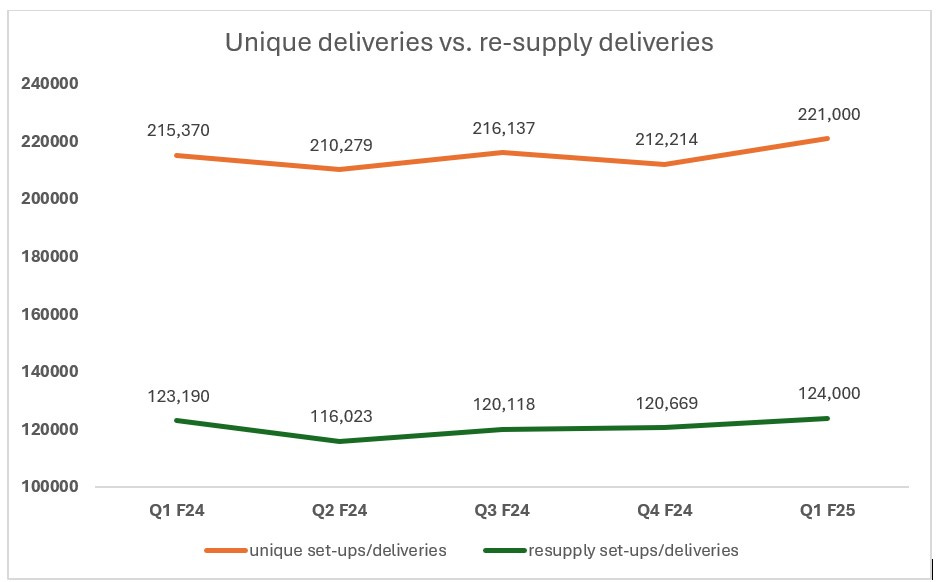

Unique vs. re-supply deliveries:

I am a big fan of Key Performance Indicators. Although there hasn’t been significant growth in unique and re-supply deliveries over the last 5 quarters, it is encouraging to see a slight improvement in unique setups/deliveries and re-supply deliveries in Q1 F25 compared to Q1 F24 and Q4 F24.

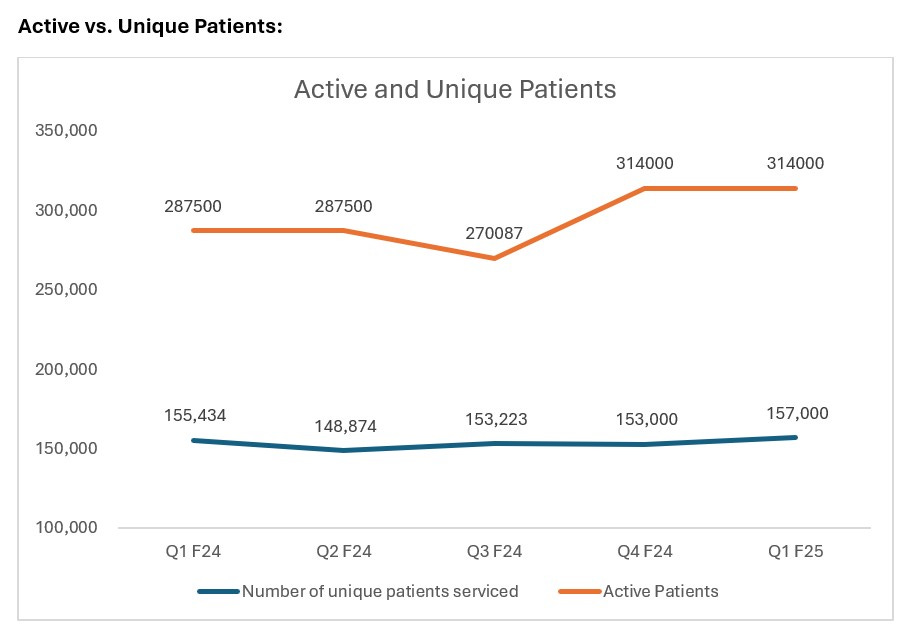

Unique patient numbers have remained stagnant, struggling to surpass the 150K-150K quarterly range. However, consistently reaching around 150K unique patients is contributing to the growth of the active patient count.

Active vs. Unique Patients:

Financial Analysis, Impact of Recent News, F25 Forecast, Valuation, Comps, and My Recommendation:

Balance Sheet: