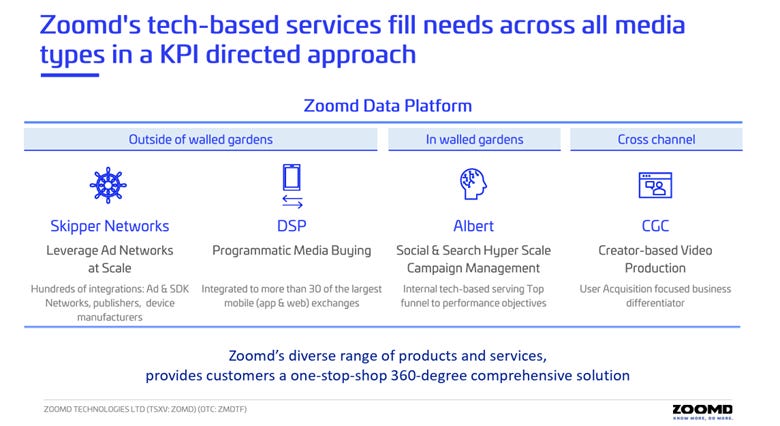

Business Model:

Zoomd is not your typical marketing company that just tries to get clicks or views. They are a performance-based marketing tech company. That means:

➡️ They only get paid if their client gets paying customers — not just app downloads, not just website visits. They help clients find real users who spend money, not just those who show interest. Zoomd helps businesses grow by managing digital advertising campaigns across a wide range of platforms. But here’s the twist:

The big platforms like Google, Meta (Facebook), and TikTok are known as “walled gardens” — you can advertise there, but you don’t really get much control. You rely on their rules, and they don’t promise you real paying customers. Zoomd focuses on the other half of the internet — all the millions of websites and digital platforms that aren’t owned by the big guys. This part of the internet is chaotic and hard to manage, and that’s where Zoomd shines. Imagine a "safari" of digital places where your customers might be. Zoomd is like a high-tech tour guide — they’ll get your message to the right spots, find you real buyers, and adjust quickly if one place isn’t working.

🧠 How do they do it?

Zoomd uses a blend of advanced software and real human expertise:

🔄 They use something like algorithmic trading, but for ads — shifting money from one site to another in real time based on what’s working.

📊 They use a system called a “knowledge graph” — kind of like a map showing where the best users are for a specific industry (e.g. fashion, travel).

🧪 They test, optimize, and re-test campaigns constantly until they get results.

🧰 They have a toolkit of software, like:

Albert AI — for managing and optimizing ad campaigns

“Keeper networks” — think of pipes connecting to hundreds of websites

Video creation tools — if the campaign needs custom content

And if one channel doesn’t work? They shift the budget and try another. Quickly.

🤝 How do clients work with them?

Clients usually agree on a budget in advance, commit to annual budgets, and pay them in advance monthly or quarterly. In short, Zoomd gets paid upfront, and then they use that money to run the campaigns. In some cases, there are pay-for-performance deals — e.g., “Spend what you want, just get me X customers, and I’ll pay you.” But mostly, it’s a fixed budget Zoomd manages — they don’t wait to get results to get paid, but they still have to deliver or risk losing the client. Many clients have stayed with them for 5+ years, which shows they’re happy with the results. In ad-tech business, there is no loyalty and seeing clients staying with them for over 5+ years is impressive.

🎯 What makes Zoomd stand out?

They don’t focus on vanity metrics like views or likes. They focus on the bottom line: real, paying customers. They operate in the wild, open part of the internet that most companies can’t handle — not just the big names like Google or Facebook. They provide full transparency and control to their clients. No mystery about where the money goes. Their system is fast, flexible, and always optimizing — like a GPS that reroutes you every time traffic shows up.

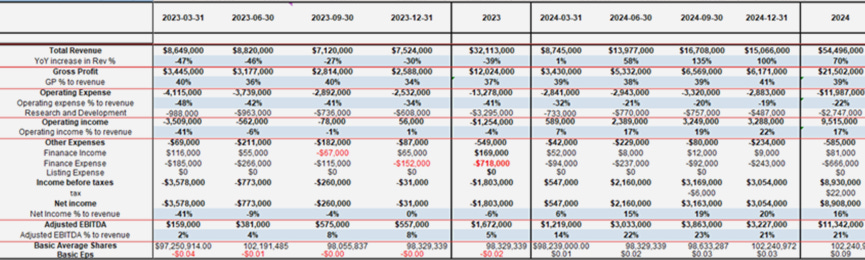

Quick peek at ZOOMD’s 2023 and 2024 Financials:

Income Statement:

Revenues: After an outstanding Q2 F24 (+58% YoY) and Q3 F24 (+135% YoY), ZOOMD's management delivered yet another record-breaking Q4 revenue surge of 100% YoY. Full-year F24 revenue rose 70% YoY, from $32M (2023) to $55M (2024).

Adjusted EBITDA: A stellar execution on revenue growth and margin expansion without increasing costs resulted in adjusted EBITDA of $11.3M in F24(21% EBITDA margin) vs. $1.7M (5% EBITDA margin) last year—a staggering 578% YoY increase ($9.7M gain).

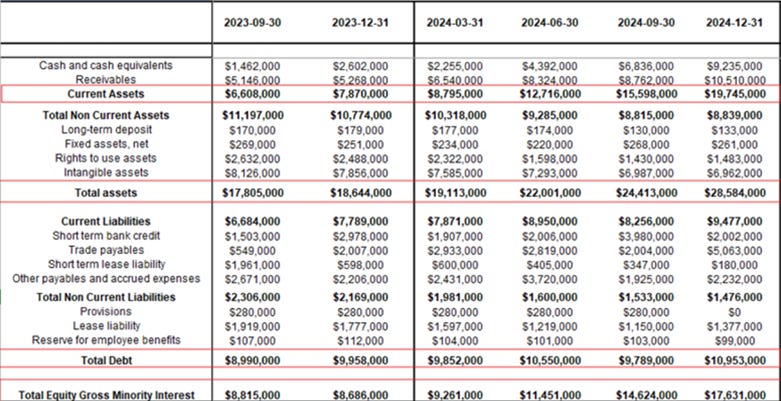

Balance Sheet:

Record year on revenue and income statement flowed to the bottom line which increase the stockholder equity by 103% from $9M to $18M USD organically!

Question: ZOMD had a record-breaking year, yet its share price declined from $1.00 to $0.40 CAD between January and March 2025. What key developments or market dynamics contributed to this sharp decline despite the company’s strong performance?

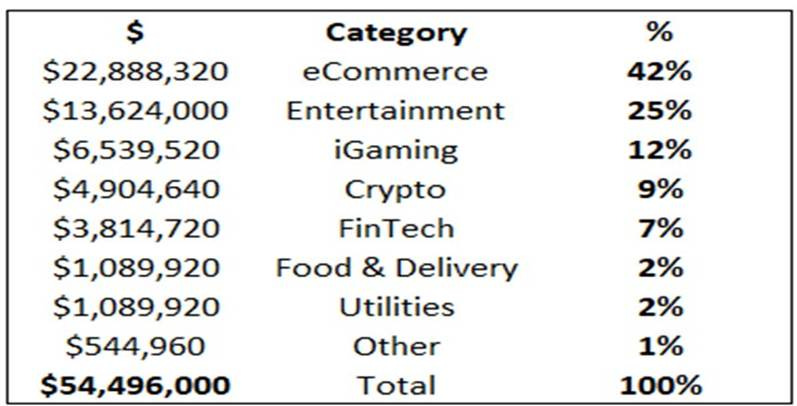

ZOMD’s F24 investor deck offers helpful transparency, showing that its largest client, SHEIN, along with Amazon Music, contributed a combined 57% of total revenue. While this level of client concentration naturally sparked some investor concern—especially regarding the potential impact of tariffs on SHEIN—it’s important to view this in context. Rather than signal immediate risk, this disclosure provides a valuable opportunity to better understand ZOMD’s current revenue dynamics, and that’s why I’d like to offer some perspective and clarity for readers here.

SHEIN:

Shein's rapid ascent in the fashion industry underscores its innovative approach to fast fashion, leveraging digital platforms and a vast global supply chain. Shein generated approximately $32.5 billion revenue in 2023, marking a 43% increase from the previous year. 2024 Forecast: Analysts projected revenues to reach $50 billion, positioning Shein alongside industry giants like Zara and H&M. Headquarters: Originally founded in Nanjing, China, Shein relocated its headquarters to Singapore in 2022 to bolster its international presence. Active Users: The platform boasts approximately 88.8 million active shoppers globally

SHEIN is a global company with an ability to shift allocation of budgets geographically. If one region — such as North America — were to slow down (and I say “if” because management has emphasized that “the momentum continues”), SHEIN can simply reallocate spending to other active markets like Europe, Transpacific, and Latin America (Emerging Market). While Zoomd remains focused on delivering paying customers, Shein expanded 50% more countries in F24, which means Zoomd Technologies has now more countries to play with and allow ZOOMD Technologies to grow even more. This is reducing geographical concentration risk.

Shein operates in over 15 geographies, all managed by ZOOMD. Importantly, the revenue from Shein comes from direct, ongoing contracts — not pilots. In short, Zoomd maintains full control over budget allocation and performance delivery, regardless of the region. Also, SHEIN has been ZOOMD’s customer for over 5+ years.

According to management:

"Even now, the momentum with this client continues to grow. They haven’t mentioned anything specific about North America, but we always have the flexibility to shift budgets if needed. Currently, we’re managing operations in over 14 countries for clients like SHEIN — including major markets like the UK, Germany, and France. These domains are so large and diverse that it’s difficult to break down the exact allocation, but what’s clear is that we’re far from disappointing either SHEIN or this other key client. The only thing I can say to investors is that the momentum continues. I said that on the earnings call as well."

This strategy is further supported by Shein’s own comments to its customers, shown in the screenshot below:

AMAZON MUSIC:

Amazon Music has solidified its position as a major player in the global music streaming industry, offering a vast library of over 100 million songs and millions of podcasts. 2023 Revenue: Amazon Music generated approximately $4.08 billion, marking a 7.9% increase from the previous year. The platform holds an estimated 11.1% of the global music streaming market, positioning it just behind Apple Music (12.6%) and ahead of YouTube Music (9.7%). As of 2024, Amazon Music boasts over 88.5 million active users worldwide. The U.S. remains its largest market, with approximately 52.5 million users, accounting for about 60% of its global audience. The platform has experienced significant growth in countries like Japan, Germany, and the UK, with year-over-year increases of 62%, 53%, and 49% respectively.

Amazon Music, a major North American client, significantly helps de-risk Zoomd revenue concentration risk. While the platform is US-based, it leverages Zoomd’s technologies across multiple international markets — essentially everywhere except the United States. Zoomd helps Amazon music to acquire clients outside North America. This is important because it demonstrates strong endorsement from a global tech leader, even though the services are not yet deployed domestically in the U.S. The fact that Amazon Music doubled its country footprint in 2024 further enhances Zoomd's growth visibility. It implies expanding demand and long-term potential for Zoomd’s technology, all anchored by a high-profile, stable client. This type of client relationship helps mitigate revenue volatility and reduces overall business risk.

NEW CLIENTS:

In January 2025, ZOOMD added some more big clients, and we've mentioned their name, and they will be strategic in size as well. All those acquired lines are expected to contribute to future growth already for this year (F25).

Go Henry, owned by Acorns, a leading fintech company focused on kids and youth financial education.

Liverpool, a top 3 retailer in Mexico renowned for its innovative shopping experiences.

Fanatics, one of the world’s largest sports merchandise company, catering to millions of sports fans globally.

NBA, a global leader in sports and entertainment, reaching basketball fans across the world.

Urbanic, a global Indian fashion giant bringing contemporary styles to customers worldwide.

Lightricks, a global leading image and video editing app developers, empowering creators globally.

I truly believe that with Shein diversifying geographically, Amazon Music generating all of its revenue outside North America, and the addition of new, strategically significant large clients, the company is now in a position where its business is diversified and can continue to grow even amid changes in macroeconomic policy.

F25 Trends:

I am sure management get this question about five times a day — but as of now, ZOMD hasn't been impacted by the tariff situation at all. ZOMD is in very close contact with its clients, including at the senior management level, because the company’s work directly affects their bottom line. ZOMD is involved with paying clients and client acquisition, and so far, there’s been no change in costs, budgets, or strategy from what’s been agreed on — whether quarterly or annually.

No shifts have been observed in that regard, and ZOMD remains in constant communication with its clients. In terms of broader trends, commerce and retail are absolutely booming right now — it’s going crazy. There are high growth rates and rising demand across the board.

Interestingly, some of the so-called “emerging markets” — and it’s debatable whether Latin America even counts as “emerging” anymore — are becoming increasingly important to ZOMD’s clients. Markets that were previously seen as secondary are now moving up in strategic priority, opening up new opportunities for the company.

According to the management at various investor conferences held in the week of April 21, 2025:

“and I will mention it again and again: the momentum that is seen here is a momentum that continues on. I get these questions a lot — what will happen in Q1, what will happen with the tariff? I’m saying once again: the momentum continues”

“So we are reaching a stage that, in terms of optimization, the system is very optimized. And this is why we went out and got a bunch of new clients. Also, we are growing within the new clients and we finally can grow within the existing clients even more. These are giant clients — billions of dollars. We are not even a fraction — one divided by 1,000 — of their marketing budget as a whole. So there’s much to grow within those”

Key F25 Catalysts:

1. Announcement of New Clients and Achievements: There will be announcements this year regarding new clients and milestones achieved with them, including expansions.

2. Regional Growth and Global Solutions: Focus on growing in various regions and providing solutions worldwide. This allows for flexibility in shifting budgets from one region to another based on market conditions.

3. Consistency in Results: By having a flexible and efficient system, the company can quickly adapt to challenges in specific countries, shifting resources to maintain consistent results across different markets.

F25 Forecast and Valuation:

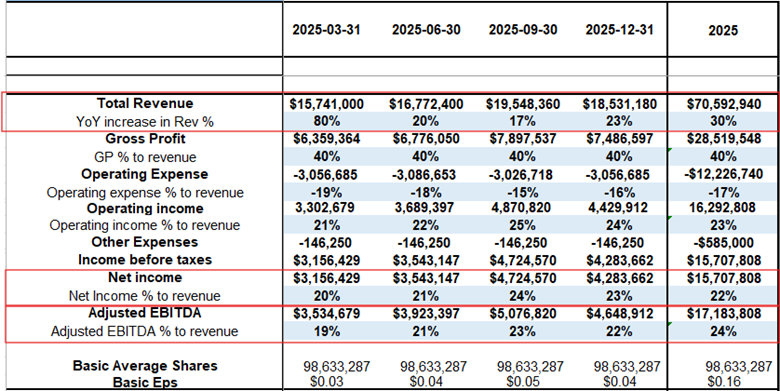

F25 Revenue forecast: $71M USD ( F24: $54M USD)

F25 Net Income Forecast: $15.7M USD (F24: $8.9M USD)

F25 Adjusted EBITDA Forecast: $17.6M USD (F24: $11.3M USD)

Valuation:

Share Price: $0.36 USD

Shares Outstanding: 98.6M

Market Cap: $36M USD

Enterprise Value: $30M

EV/F24 Net Income: 3.37x

EV/F25 Net Income: 1.91x

Businesses with this level of growth are seldom available at such attractive valuation multiples. Therefore, I continue to be a buyer

Insider Ownership:

Management owns roughly about 33% this mainly the co-founders and the management

Conclusion:

I am confident that the momentum will persist, and I stand firmly behind my forecast. I continue to expect ZOMD to reach its fair value of $1.80 CAD in due time. Until that day arrives, I sincerely appreciate your attention and support.

Warm regards,

The Microcap Contrarian – Rahil Gillani

If you enjoyed this analysis on ZOMD, consider subscribing to my Substack for more in-depth insights and updates.

Disclosure:

1. No compensation was received for the preparation of this report.

2. The information presented in this report is based on publicly available data and sources believed to be reliable. However, I make no guarantees regarding its accuracy or completeness.

3. This report is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research or consult a financial advisor before making investment decisions. All investments involve risk

4. I and my immediate families do not have any conflicts of interest with this company.

5. This report is for informational purposes only and does not constitute investment advice.

Great work!

Thank you very much for writing, I've also owned ZOOMD for a while.

I want to understand, but where did you come to the conclusion about SHEIN and how did you understand that their second largest customer is Amazon Music?